Growth Sustained by Flexibility and Resilience

Digital Credit Fintechs Survey 2024

Credit fintechs in Brazil have shown remarkable resilience and adaptability in 2023, as indicated in the fourth edition of the Digital Credit Fintechs Survey, conducted by PwC and the Brazilian Digital Credit Association (ABCD). This evolution is a continuation of the trend observed in the previous survey.

Despite a volatile financial environment, credit fintechs not only maintained their growth but also significantly expanded their operations. Credit volume grew by 52%, totaling R$21.1 billion, reflecting consumers’ growing confidence in digital financial services.

These companies have consolidated their operations, expanded their teams and increased their revenue, reinforcing their position in an increasingly competitive market. The expansion of the customer base, especially in the Northeast, demonstrates a progressive decentralization, adapting to the demands of the domestic market.

With 53% of fintechs planning to invest in artificial intelligence in the next two years, this technology continues to be central to the sector’s strategies. The focus now is on improving customer relationships by leveraging the capabilities of generative AI.

52%

was the increase in the volume of credit granted by fintechs, which reached R$21.1 billion in 2023.

58%

of companies are now consolidated, with annual revenue or total investment above R$20 million, representing a growth of ten percentage points since 2022.

35%

of fintechs have more than 150 employees, an increase of four percentage points compared to the previous year.

79%

is the growth in the number of individual customers, which reached 46.7 million in Brazil and around 7 million abroad.

53%

of those interviewed point to artificial intelligence as a technological priority for the next two years, with an emphasis on generative AI.

Strengthening and Stability in the Fintech Sector

Accelerated growth in credit volume. Digital credit fintechs demonstrated a significant recovery in 2023, after a slowdown in the previous year. The volume of credit released increased by 52%, totaling R$21.1 billion. This result highlights the resilience and adaptability of companies, even in a challenging economic scenario characterized by high interest rates. The growth strategy was based mainly on organic growth, with a constant launch of products over the years.

Annual volume of credit granted (R$ million) and year-on-year growth

Expanding workforces . Our 2023 survey revealed a maturation of digital credit fintechs, with several companies expanding their workforces beyond 300 employees, as well as an increase in the 21-50 employee range. We also observed a decrease in the proportion of smaller companies with up to 20 employees.

Growth in consolidation . Between 2022 and 2023, the percentage of consolidated fintechs (with revenue or investment exceeding R$20 million) increased by ten percentage points, now representing 58% of the companies analyzed.

Expansion of operations for individuals and legal entities . The number of companies offering solutions for both individuals (individuals) and legal entities (legal entities) grew again in 2023, with an increase of 17 percentage points compared to 2022.

Increase in fintechs with authorization from Bacen . Almost half of the fintechs surveyed (46%) already have a license from the Central Bank of Brazil to operate as a Direct Credit Company (SCD) or a Peer-to-Peer Lending Company (SEP), an increase compared to the 11% registered in 2019. In addition, 8% are awaiting the release of licenses already requested.

Diversification of operating models . Although digital banking correspondents and SCDs continue to be the predominant models, there is a clear trend towards diversification, with growth in other areas such as payment institutions, SEPs and Credit, Financing and Investment Companies (SCFIs). This movement reflects an evolution of the market to meet the diverse demands of consumers and companies.

Greater acceptance of collateral . There has been a significant increase in the willingness of firms to accept a wider range of collateral. This shift can be interpreted as a strategy to mitigate risk, attract a larger customer base and compete more effectively in the financial market.

In Brazil, the number of individual clients of fintechs grew significantly, rising from 25.6 million in 2022 to 46.7 million in 2023, representing an increase of 82%. In the international market, growth was 58% in the same period.

The research also reveals greater geographic diversification among individual customers in 2023. Although 74% of fintechs are concentrated in the state of São Paulo, there has been a continuous increase in customers in the Northeast region, which already exceeds 17.5 million people.

Total Number of Individual Customers (in millions)

Exponential Growth of the Individual Customer Base

Expansion of the Offer of Credit Products. In 2023, fintechs expanded and diversified their range of credit products, taking advantage of the post-pandemic economic recovery to grow and reach new market segments. The focus on non-consigned personal credit and credit cards reflects a greater appetite for risk, although this strategy is balanced through diversification, which includes safer options, such as consigned credit aimed at INSS beneficiaries.

Fintechs offering the following products %

Interest Rates for Individuals . The decrease in interest rates in seven credit categories for individuals highlights how fintechs have adapted to the economic scenario, characterized by the gradual reduction of the Selic rate in 2023. This situation has allowed companies to offer more advantageous credit conditions and expand their operations. Although the revolving credit card of fintechs has a rate of 242.4% per year, this value is considerably lower than the national average of 440.8% per year, according to data from the Central Bank of Brazil.

Annual interest rate by product type

Default. Our research indicates a decrease in the default rate across several product categories over the years. At the same time, we observed a considerable increase in default on revolving credit cards, highlighting the challenges in risk management in this category.

Evolution of default

Support for small and medium-sized businesses

More savvy corporate clients. Our research indicates a shift in the corporate client base of credit fintechs, revealing an increase in the size of the companies they serve. This trend indicates that fintechs are succeeding in driving business growth, especially by facilitating access to credit for small and medium-sized businesses, which now constitute a growing portion of their clientele. This panorama also demonstrates that fintechs have been able to adjust their products and services to meet the demands of a wider range of businesses.

Distribution of customers by revenue

Interest rates applied to legal entities. The research showed a decrease in interest rates for loans, both secured and unsecured, between 2020 and 2023. This trend indicates a continuous adaptation of fintechs to the market environment, as well as the impact of the monetary policy of gradually reducing the Selic rate.**

Average annual interest rates

_page-0001.jpg)

In total, 62% of the fintechs surveyed serve legal entities, either exclusively or not. The increase in the supply of rural credit and long-term working capital reflects the commitment of fintechs to support sectors that require significant and sustained investment. The stability observed in the supply of discounts on invoices and receivables suggests that this traditional financing method continues to be an essential tool for managing companies' cash flow.

Fintechs offering the following products %

Default. In 2023, fintechs managed to improve credit management and reduce default in the main categories of products and services for companies. The average default rate in fintechs' companies' portfolios (3.9%) is close to the general average reported by the Central Bank (3.5%), indicating a robust performance of fintechs in this aspect.

Evolution of the default rate

Competitiveness: Main Challenges

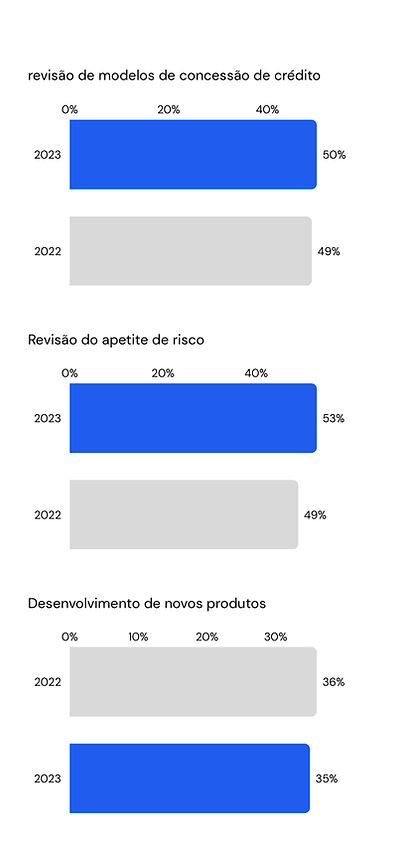

Fintechs have implemented several strategies to improve their performance and sustain competitiveness. There was a clear focus on improving credit conditions and processes, reflected in the increase in reviews of rates, limits and terms. The reassessment of risk appetite and the consistency in adapting credit granting models also indicate that the sector is committed to maintaining its solidity and competitiveness. In addition, the development of new products demonstrates a tendency towards innovation, even if there was a slight reduction in relation to the previous year.

Actions to improve performance

_page-0001.jpg)

_page-0002.jpg)

Flexibility in Raising Funds. In 2023, fintechs faced difficulties in attracting external investments due to market volatility and rising capital costs. In response to these challenges, there was an adaptation in fundraising strategies, with greater diversification of financing sources. The use of equity capital increased, in part due to the increase in the granting of operating licenses by the Central Bank, which requires significant contributions from companies. The new strategies also included an increase in the use of debentures and certificates of receivables, aiming to reduce dependence on external capital.

A New Focus on Artificial Intelligence. Fintechs already use artificial intelligence (AI) to model and assess credit, seeking to determine consumer eligibility and the most appropriate rates. With the advent of generative AI, however, the focus is expanding to process automation, especially in customer service areas. This could result in a significant increase in productivity and transform the interaction between companies and consumers, allowing bots to respond to users’ questions in a contextualized way.

Financial Innovations. The central bank’s digital currency, Drex, and interoperability solutions have the potential to play a key role in reducing barriers in the financial market, creating a more equitable environment for new entrants and increasing competitiveness.